Most of us grow up being told to “save for the future.” And yes, saving is good. But here’s the thing—if all we ever do is save, our money quietly loses its power because of inflation.

That’s why I often share in our financial seminars: we don’t really have a choice but to invest.

A Simple Example: ₱3,000 a Month

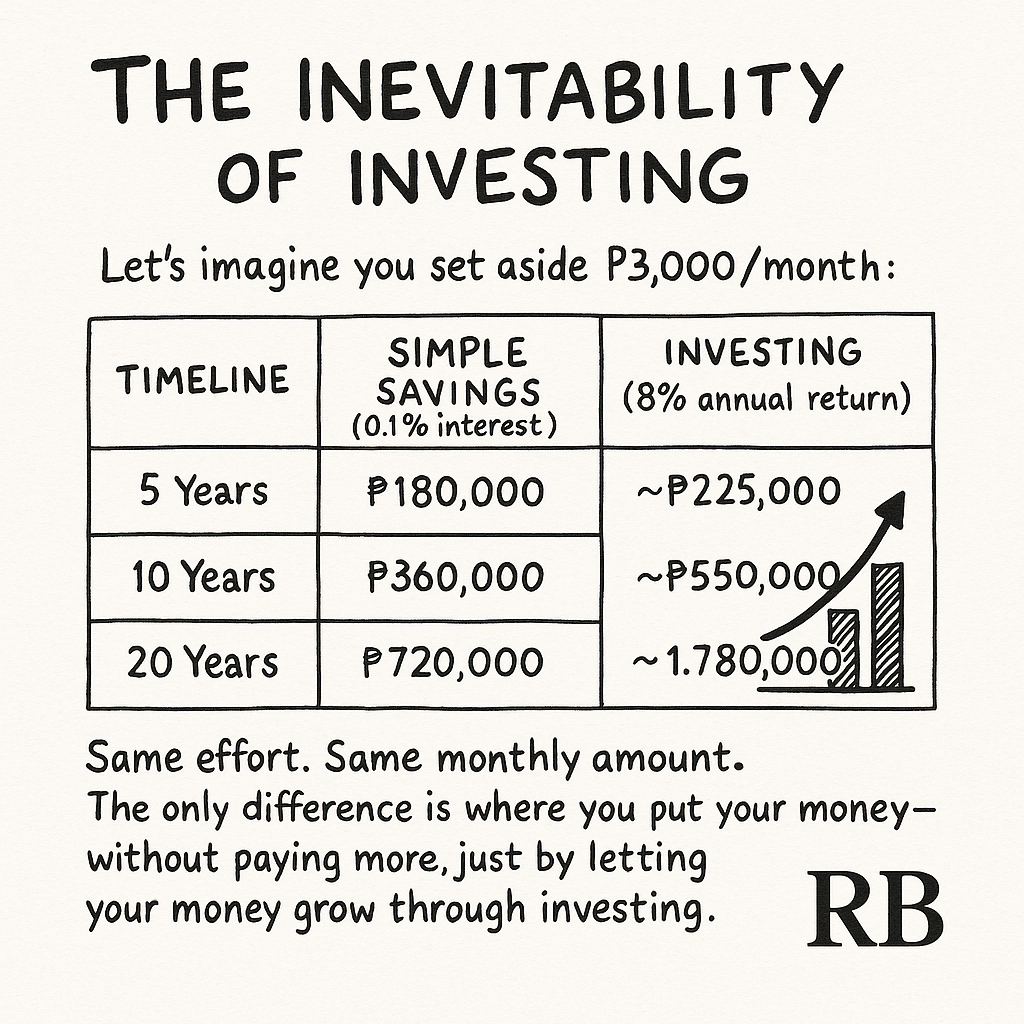

Let’s imagine you set aside ₱3,000 every month. Here’s what happens over time:

Timeline Simple Savings (0% interest) Investing (8% annual return, yearly compounding)

5 Years ₱180,000 ~₱211,000

10 Years ₱360,000 ~₱522,000

20 Years ₱720,000 ~₱1,647,000

💡 Same effort. Same monthly amount. The only difference is where you put your money.

By year 20, investing gives you almost ₱1 million more—without paying extra, just by letting your money grow.

This is why saving alone is not enough. If you want your hard-earned money to keep up with rising prices, investing is the only way forward.

Common Questions People Ask

1. Do I need a big budget to start?

Not at all. You can begin with an amount that fits your lifestyle and increase it as your income grows.

2. Is this only insurance?

No—it’s both savings and protection. One part grows your money, while the other part secures you with insurance.

3. What if I already have insurance?

That’s fine. This type of plan can complement what you already have and help you build savings faster.

4. Can I withdraw my money anytime?

Yes, there are flexible options for partial withdrawals while keeping your protection active.

5. Who can avail this plan?

Anyone—from fresh graduates starting out, to professionals building wealth, to parents securing their family’s future.

Why This Matters Now?

This September, we are running a financial literacy drive to reach more people. I believe that simple insights like this—how ₱3,000 a month can turn into ₱1.6 million—can change how families prepare for the future.

If you think this is valuable, please share it with your friends. If you’d like to know more, I’d be glad to walk you through how you can start.

Final Thoughts

Saving is good. But investing is what makes saving truly work.

At the end of the day, it’s not really a choice between the two—investing is the inevitable step if you want your money to grow and protect you in the future.